Sales Dropping? Market Data Might Help You Understand Why & Find a Solution

When sales decline, it’s easy to assume it’s a brand issue. But sometimes, the shift isn’t internal – it’s the market itself that's changing.

During ongoing performance monitoring for a premium coffee brand in the US, we uncovered a puzzling trend. There was a sharp drop in consumer demand both for coffee and machines.

Revenue was falling, and search volume on Google Ads for coffee in the US had dropped by 45% over just two months. Our client was feeling the impact, including a 20% dip in demand for their coffee machines.

Something had shifted in the market. But what?

Market Analysis Through Data

To uncover the root cause, we turned to market data. Specifically, focusing on the brand’s addressable market: super-automatic espresso machines priced up to $600, which represents value-conscious consumers seeking quality machines at accessible price points.

What we found was a pattern hiding in plain sight.

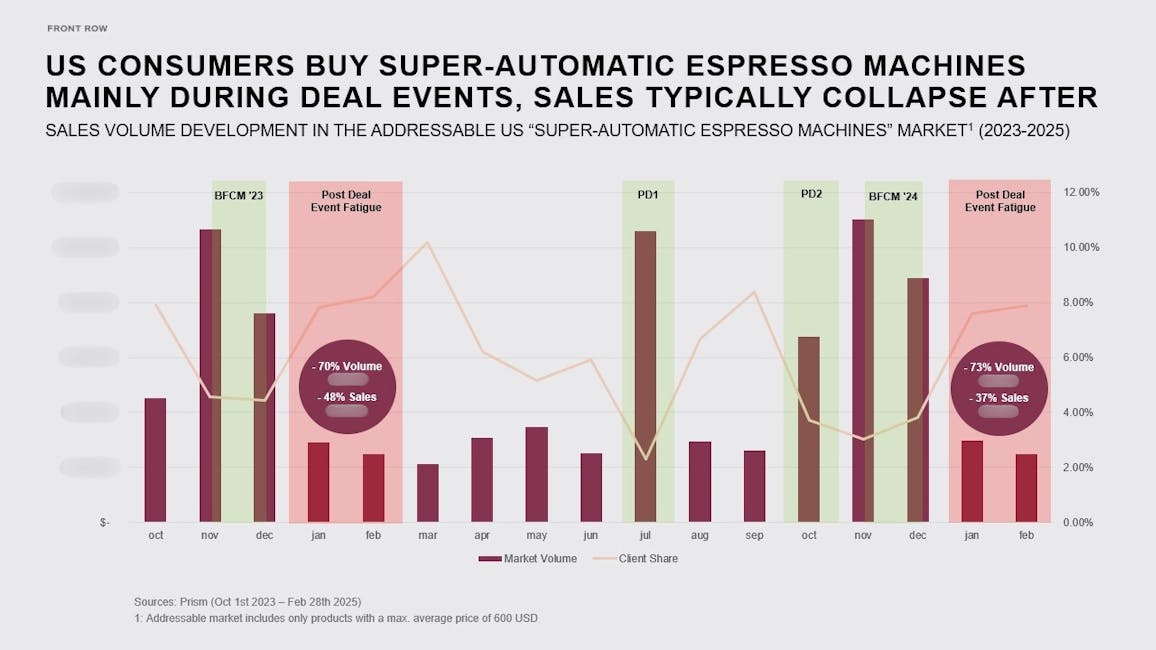

Deal Events Driving and Distorting Demand

The data revealed a clear purchasing behavior: Super-automatic espresso machines are among the products that consumers in the US primarily buy during major deal events like Amazon Prime Day and Black Friday/Cyber Monday (BFCM). Sales drop significantly outside these windows, creating a feast-or-famine cycle for brands in the space.

319%

During Amazon’s Prime Days in July 2024, addressable market sales surged by 319% from June to July.

72%

By August, market sales plummeted 72%.

Our client experienced a similar, though more moderate, trajectory: up 63% in July, then down 20% in August. A comparable pattern played out during BFCM 2023:

- Addressable market sales increased 136% from October to November.

- Comparing sales of November-December 2023 with January-February 2024, market figures fell sharply by 70%.

Our client again mirrored the post-deal event fatigue trend, where sales increased in July during deal events, then decreased in August. But deal events weren’t the only piece of the puzzle.

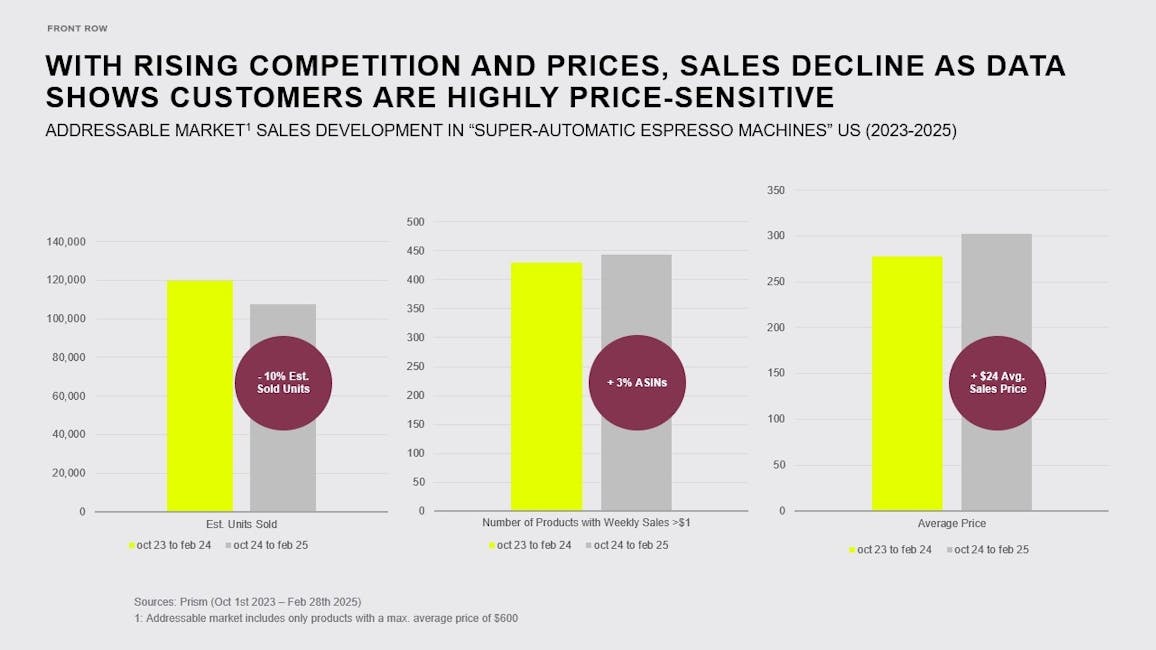

A Market Under Pressure

Over a five-month period (October to February), we noticed a deeper issue: unit sales in the addressable market dropped 10% year-over-year. The number of available ASINs increased by 3%, and the average price rose by $24. This revealed two key truths:

- Competition is intensifying.

- Consumers are becoming more price-sensitive.

Price sensitivity isn’t new in this space – it’s a defining trait of categories like espresso machines (and similar discretionary purchases, like vacuum cleaners), where prices often range from $150 to $600. These are not urgent, must-have-now products. Shoppers can wait months for the right deal. What the data suggests is that this sensitivity is becoming even more pronounced.

As inflation and economic pressure continue to influence consumer behavior, value-driven decision-making is only gaining ground.

Translating Insights into Strategy

For our client, these insights had immediate implications. They can now:

- Understand the value thresholds customers respond to

- Adjust deal strategy to avoid over-reliance on deal spikes

- Position products more clearly within the value-price sweet spot

- Prepare for tighter competition and more discerning buyers

Stay Ahead of the Market with Front Row

In a market where consumer behavior can shift swiftly, and often invisibly, brands can’t afford to fly blind. At Front Row, we use market share data to detect changes early, distinguish noise from trend, and help clients navigate complexity with clarity.

Because when the market moves, the right insight can mean the difference between catching up and leading the way.