How Front Row Brands Won Black Friday & Cyber Monday on Amazon

Black Friday/Cyber Monday (BF/CM) in 2025 reinforced a clear shift in where consumer dollars concentrated, and beauty led the charge.

During the core weeks of the event (defined here as the weeks of Nov 23 and Nov 30, 2025), Beauty & Personal Care was the #1 category in consumer spend growth, reaching $2.1 billion in estimated sales, up +16% year over year from last year’s event, and moving 114.3 million units, a +19% increase versus BF/CM 2024. Average product spend in beauty held steady at $191, signaling that growth was driven by volume and demand, not inflationary pricing alone.

That performance outpaced adjacent categories, including Health & Household and VMS, which each grew +11%, underscoring Beauty’s outsized role during Amazon's most competitive shopping moment of the year.

For Front Row-managed brands, BF/CM validated a broader operating truth: tentpoles reward brands that plan early, activate holistically, and treat peak moments as systems, aligning portfolio strategy, retail media, creative, inventory, and pricing into a single executional rhythm.

Front Row brands consistently converted heightened demand into sustained momentum. The driver wasn’t deep discounting, but rather disciplined execution across deals, media, merchandising, and timing.

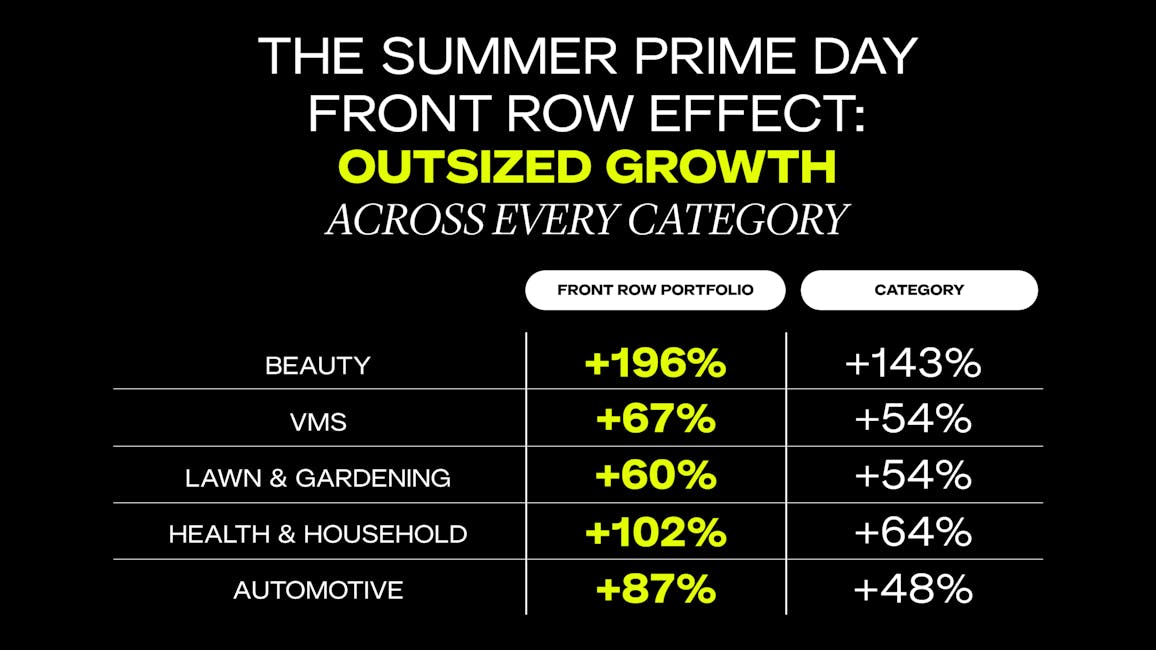

Front Row Outperformed the category for Beauty and VMS during BF/CM:

Front Row Beauty brands who participated in the event both years grew +37% YoY, vs category +16% during core event weeks

Front Row VMS brands who participated in the event both years grew +28% YoY, vs category +11%

How Front Row Brands Outperformed During Black Friday & Cyber Monday

During the event shopping window, Front Row-managed brands delivered outsized performance across the most competitive days of the year. Daily sales grew 77% above the baseline, with Black Friday peaking at 219% above baseline and Cyber Monday reaching 200%, a meaningful acceleration compared to 2024.

Performance was strongest among brands that treated BF/CM as a system. Front Row Beauty brands grew 50% year over year during the shopping holiday, and 67% among brands that activated deals. VMS brands followed a similar pattern, delivering 27% YoY growth with full participation across the category.

Timing proved decisive. Products that launched deals ahead of Thanksgiving saw 143% sales growth, with those that waited until the holiday itself saw only a minor lift.

Why Front Row Brands Consistently Outperformed

These outcomes weren’t accidental. Front Row operates tentpoles as part of a continuous, year-round Amazon operating system. That approach shows up clearly in the data. During Prime Day week, sales surged immediately when deals went live and remained elevated through the event, with peak performance at 8 AM and 8 PM, and an unexpected rebound on Friday evening, the highest-performing hour of the entire week across participating brands.

Brands that launched earlier benefited disproportionately. During the event, products that activated deals before Thanksgiving saw 143% sales growth, compared to just 25% growth for products that waited until the holiday itself to launch deals.

Rather than treating tentpoles as isolated spikes, Front Row used each event to compound momentum for its brands: Prime Day into Fall Prime, Fall Prime into Turkey 12, and Turkey 12 into Q1.

Featuring Scrub Daddy's Amazon Success in Partnership with Front Row

Scrub Daddy dominated their category during BF/CM in 2025, a testament to their ongoing partnership with Front Row and our unique approach to the CPG section of the marketplace. We partnered with Scrub Daddy to rethink their Amazon assortment, logistics model, and demand planning to drive sustainable growth on the platform. These three pillars have been foundational for Scrub Daddy to achieve BF/CM success, and the brand dominated their respective category.

Scrub Daddy finished as the #1 top-selling brand in Sponges, outperforming legacy players like Scotch-Brite and capturing three of the five top-selling ASINs, including the top two spots in the category. It’s a clear example of how strong fundamentals and disciplined execution translate into category leadership when demand peaks.

Want to learn more about our approach to Scrub Daddy’s ongoing Amazon success? Read our case study here.

What This Signals for 2026

The lesson from 2025 is clear: tentpoles are structural growth levers that expose how well a brand is actually operating on Amazon.

These moments expose how well a brand actually operates on Amazon. When demand concentrates, execution gaps surface quickly. Building discipline and making it repeatable is only possible with a partner that understands the nuances of the Amazon ecosystem. And it’s exactly that discipline that separates short-term wins from sustained growth.

Looking to maximize your 2026 Amazon results through a strategic, long-term operating model? Contact our marketplace experts today to learn more.