Small Badge, Big Impact: Maximize Black Friday Sales with Amazon Deal Badges

In a sea of competing Black Friday Cyber Monday (BFCM) offers, even standout Amazon brands can get lost. But a simple Deal Badge can go a long way.

At Front Row, we analyzed the BFCM 2024 performance of one of our clients, a global consumer goods group with a diverse portfolio of personal care, home, and snacking products. What we uncovered reinforced a simple, strategic truth: The presence of a deal badge plays a crucial role in driving performance – beyond the discount itself.

More Than a Discount

While Prime Exclusive Discounts (PEDs) don’t always automatically come with increased visibility, they are highlighted just as strongly as Amazon’s official deal badges when marked as deal events. For example, when PEDs are tied to official Amazon events such as Spring Deals, Prime Day, or BFCM, they receive the same level of visibility as products submitted through Amazon’s self-service deal submission or directly via Amazon contacts.

In addition, Amazon recently expanded its PED offering to be available year-round – not just during major events like Prime Day or BFCM. This means more flexibility for brands to run PED promotions at any time, achieving sustained engagement with Amazon’s most loyal and frequent shoppers. While BFCM remains an optimal time to take advantage of PEDs, brands now have the opportunity to use this tool throughout the year to boost visibility and drive conversions.

Regardless, choosing the right deal format – with the right deal badge – is essential for improving ROI during high-traffic events. Our numbers back this up.

Visibility, Trust, and Intent: All in One Badge

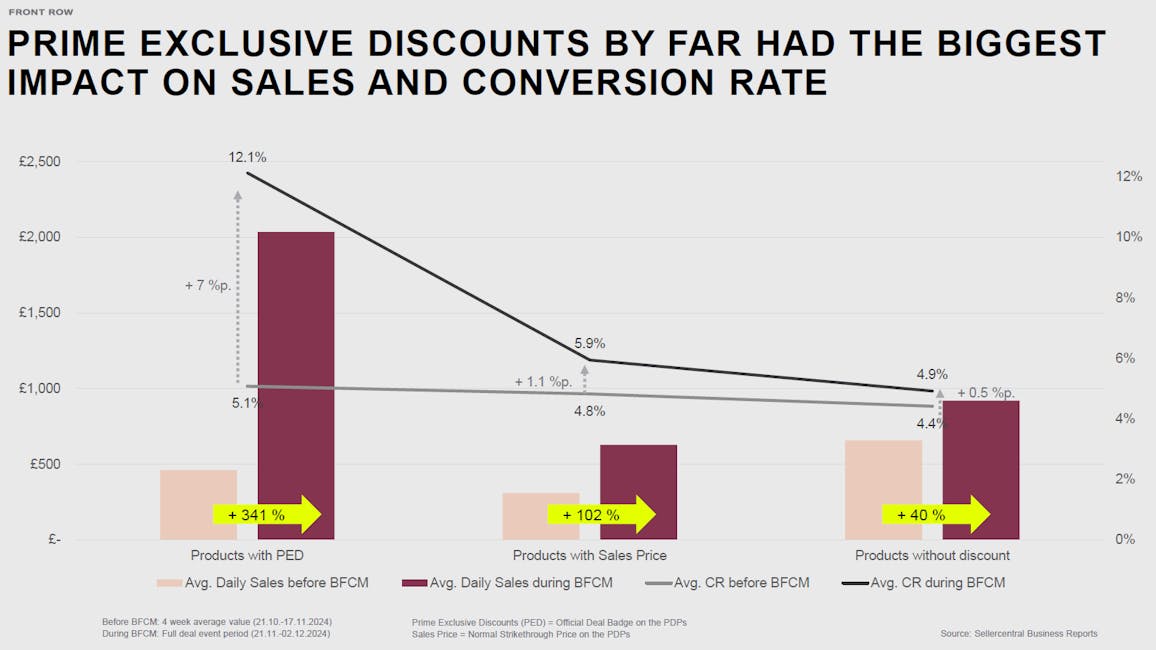

When we looked at the BFCM 2024 data for our client's personal care and home brands, we saw a clear picture:

- Products with an Amazon Deal Badge saw a +341% increase in daily sales compared to the pre-BFCM period.

- Products with a standard sale price grew just +102%, while items without any discount saw only modest gains at +40%.

- Conversion rates told the same story. Products with a deal badge gained a full 7 percentage points, while sale-priced items inched up by just 1.1. For non-discounted products, the lift was negligible at +0.5 points.

Why such a dramatic difference? It comes down to how the Amazon Deal Badge functions. It’s more than just a price cut, it's a trust signal. The badge highlights exclusivity (like Prime Exclusive Discounts for Prime members), reinforces urgency, and stands out visually in a high-traffic, high-intent shopping environment. For time-sensitive events like BFCM, that distinction matters.

A Tactical Detail with Strategic Impact

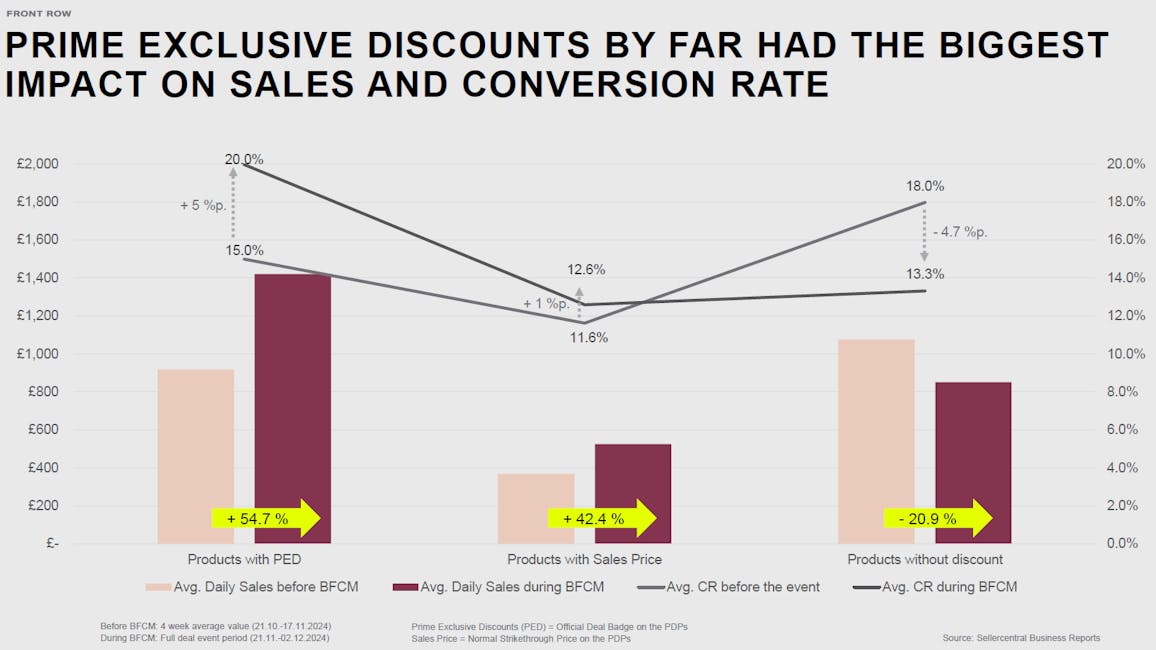

The same pattern held in the snacking category as well:

- Another brand of our client saw a +54.7% lift for products with a Deal Badge. Standard sales brought in a +42.4% lift.

- But products that ran without a discount didn’t just underperform – they lost sales, with figures down -20.9%.

- Even more striking? Those non-discounted products also saw a drop in conversion rate, down 4.7 percentage points. Meanwhile, deal-tagged products climbed 5 full points.

What might seem like a small executional choice – applying the right offer type – actually plays a major role in how customers discover, evaluate, and convert. Price elasticity varies by category, but the battle for visibility is universal. If your discount isn’t front and center, your product likely won’t be either.

Seasonal Insights Bring Year-Round Success

Let's emphasize this again: Amazon Deal Badges are essential to incorporate into your wider promotional strategy for deal events like BFCM. This is especially true when they are paired with retail media, display and other ad formats, alongside competitive pricing and product-level strategy.

With PEDs now available year-round, brands can engage Prime members not only during seasonal events but at any time, helping to sustain visibility and maximize sales over a longer period. By pairing PEDs with other strategic promotional efforts, brands can develop a more consistent and effective sales strategy.

At Front Row, we help brands identify high-leverage moves like this one: drawing insights not just from high-level trends, but from the product-level data that reveals what’s working, and what’s not. Interested in running smarter, faster promotional strategies that meet the moment? Let’s talk.