Prime Day 2025: A New Reality for Brands

Prime Day used to be a moment where brands made a month’s worth of revenue in two days. For some categories, that may still hold, if the deal is aggressive, and the execution flawless. But in most cases, those days are over.

As an agency working with brands across categories and maturity levels, we’ve seen the shift play out in real time. Participation alone no longer guarantees results. The market is saturated, attention is fragmented, and the conditions that once created success are fading.

This year, we came into Prime Day asking not just what performed, but what it took to perform. The answer? Precision, not only presence. And that shift comes with strategic implications. Below, we unpack what actually happened during Prime Day 2025, across shopper behavior, category dynamics, and media execution, and what it signals for brands reconsidering their place in this event going forward.

Four Days, But No Bigger Pie

In June this year, Amazon announced that Prime Day 2025 would be four days. On paper, that may have sounded like a bigger opportunity for some. In practice, it mostly diluted urgency.

According to Momentum Commerce, total Amazon U.S. sales during Prime Day 2025 grew just 4.9% compared to the combined performance of Prime Day 2024 and the two days immediately following. For an event that doubled in length, that growth is underwhelming. This confirms what we suspected before the event: this wasn't about expanding the pie. It was about slicing it thinner.

We saw that play out in shopper behavior: With more time to browse, people took that time. Based on Similarweb data, daily visits to Amazon.com in the U.S. dropped 15% year over year during the Prime Day window. App usage followed the same pattern, down 9% compared to 2024. Shoppers were slower to act, and the urgency that usually drives conversion on Day 1 and Day 2 simply didn’t materialize in the same way.

Advertisers adjusted to this year's conditions, but not always effectively. Findings from Kenshoo Skai show that U.S. brands spent nearly three times more per day on Amazon Ads during Prime Day 2025 than in the 30 days prior. Yet spend was spread thin. During the second half of the event, ad investment was flat year over year, while clicks still rose by nearly 20%. That disconnect suggests brands were pacing budgets conservatively rather than leaning into late-event momentum.

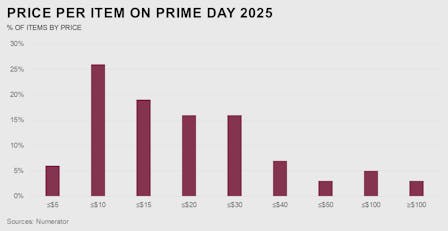

Meanwhile, value perception also shifted. Numerator reports that two-thirds of Prime Day items sold in the U.S. were priced under $20, and the average order value was just $53.34. That skew toward low-ticket items might boost volume, but it doesn’t lift total revenue unless conversion is tight and spend is sharp. The result was more noise, not necessarily more lift. For brands without real-time agility, the extended format became a liability and not a lever.

Not Every Deal is a Good Deal

Some brands entered Prime Day for the first time this year with high expectations. One of our UK-based clients ran a top deal on their best-selling product, which had strong baseline performance, premium positioning, and real momentum leading into the event. However, it underperformed.

- The issue wasn’t the product or the offer – it was the landscape. The category was flooded with discounts, and every comparable SKU had a badge.

- This was reflected in overall market numbers as well: As per Momentum Commerce, 25.6% of products in the U.S. were discounted during Prime Day, and at the same time, average discount depth dropped to 21.7%. In simpler terms: more products were on sale, but the discounts themselves were smaller, so shoppers had more to choose from, but less reason to act.

- As the event progressed, the pressure only built: Deal coverage peaked at 26.7% by Day 3, meaning competition for attention only intensified as the event went on. In that environment, even well-performing SKUs struggled to break through.

Visibility became a volume game, and unless promotions stood out meaningfully, they got lost. This reinforced the fact that deal participation without a clear plan or point of difference is just participation. In oversaturated categories, that may be more likely to hurt your brand than boost it.

Growth at a Cost

Some others entered Prime Day with a simple goal: show up, be seen, and grow. But what happens when the cost of showing up outweighs the gain?

With one of our clients, the deal strategy was nearly identical to last year. But this time, pricing pressure and declining average selling prices muted any upside, as the skew toward low-cost purchases, combined with broader discount saturation, pulled down pricing benchmarks across categories.

The complexity here isn’t just about execution, context also plays a significant role. Competitive pressure from new entrants, low-priced alternatives, and fading branded search volume all compound to make even familiar strategies less effective over time. This is where surface-level performance may look solid, but underneath, margin is eroding, and long-term brand health is at risk. Chasing share without clear ROI modeling can come with a cost heavier than you think.

Category Sensitivity is Not Created Equal

Complex, high-ticket systems still see Prime Day gains. Shoppers often delay considered purchases until a trigger like Prime Day comes along. But even then, the uplift is more about timing than sheer volume.

- Adobe Analytics data supports that behavior. In the U.S., sales of big-ticket and planned-purchase categories jumped during Prime Day: appliances were up 112%, electronics up 95%, and tools and home improvement up 76% compared to average daily sales in June. These are not impulse categories, they’re categories where Prime Day simply pulled demand forward.

- On the other hand, evergreen essentials showed limited sensitivity. Numerator’s top-selling Prime Day items in the U.S. included protein shakes, dish soap, and paper plates – purchases that likely would have happened regardless of the event. These items reflect routine replenishment, not event-driven behavior.

The takeaway here is that understanding where your category sits on the urgency-to-routine scale defines whether Prime Day is a genuine opportunity or just a noisy detour.

The Bottom Line

One of the most useful framing questions we asked this year was: Does the input justify the output? Media, margin, operational effort – what did it actually return?

Prime Day 2025 reminded us that results aren’t guaranteed. The brands that won had a reason to be there, a plan, and the flexibility to adapt when things didn’t go as expected. For everyone else, it was a reminder: showing up is not the strategy.

Across markets, one theme remained clear: Performance came from precision. Whether through full-funnel media, well-structured promotions, or careful category planning, success depended on alignment. As we highlighted in another Prime Day 2025 analysis, the strongest results came from deliberate, measured execution – not just participation. Prime Day is no longer the center of gravity, it's one lever among many. Use it when it fits your goals, not just because the calendar says so.

We’ve developed category-specific Prime Day recaps for our clients. If you're looking to benchmark performance or pressure-test your 2026 approach, let’s talk.