Prime Day 2025: How Front Row Brands Outperformed the Market

Amazon’s 2025 Prime Day is in the books and once again, Front Row clients delivered exceptional results. In a year marked by greater competition, more deals, economic uncertainty, and shifting consumer behavior, our brands stood out. Backed by our proprietary insights platform, Catapult, and a rigorous promotional strategy, Front Row clients outpaced category benchmarks across the board.

Here’s what we saw, what we learned, and what it means for the rest of 2025.

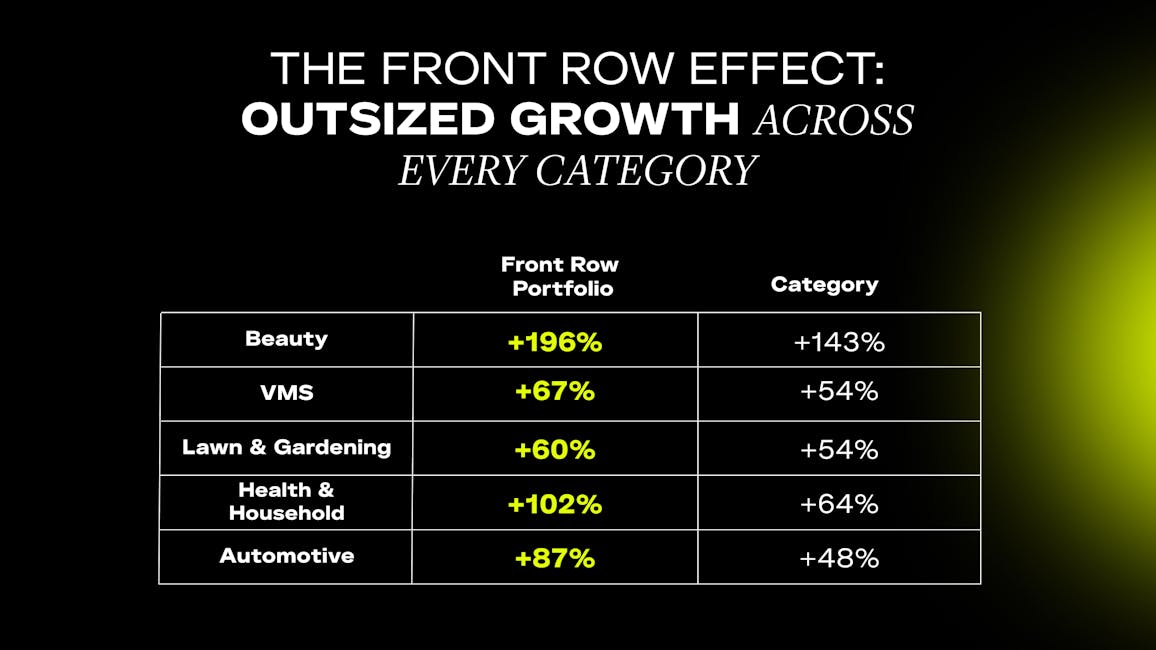

The Front Row Effect: Outsized Growth Across Every Category

Across all key categories, the Front Row portfolio outperformed the market in week-over-week growth, often by double digits.

This kind of performance doesn’t happen by accident. It’s the result of coordinated activation, smart promotional strategy, and full-funnel execution across media, content, and retail operations. Powered by Catapult, our proprietary analytics engine, we ensure every lever is pulled for maximum impact.

That’s The Front Row Effect: outsized gains, new customers, and sustainable marketplace momentum.

Front Row Brands Outpaced the Pack with 77% YoY Growth

While Others Grew, Our Brands Soared

Prime Day 2025 delivered solid growth across most major Amazon categories, with year-over-year gains reflecting broader consumer confidence and increased platform engagement. But for brands partnered with Front Row, performance exceeded even those elevated benchmarks.

Our clients saw an average 77% increase in sales compared to Prime Day 2024, a surge driven by precision planning, first-party data, and optimized execution through our proprietary Catapult platform. Whether in beauty, wellness, or personal care, the results were anything but average.

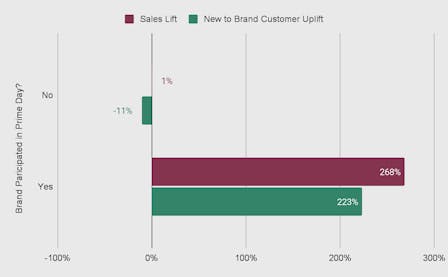

Shoppers Were Looking for Promos

One of the clearest takeaways from this year’s event: simply being available on Amazon isn't enough. Brands that did not participate in Prime Day with promotional activity saw no meaningful sales lift. In contrast, participating brands — those with Prime Exclusive Discounts, Best Deals, or Strike-Through Pricing — saw a 268% increase in sales over the 4-day Prime event.

Crucially, a large share of that growth came from New-to-Brand customers, making Prime Day not just a conversion play but a top-of-funnel engine. This year, shoppers weren’t just browsing or reordering. They were exploring, discovering, and buying from brands they hadn’t engaged with before.

As we look ahead to back-to-school, fall, and Q4, the brands that win will be the ones who turn Prime Day shoppers into long-term loyalists. That means:

- Retargeting new customers with relevant creative and messaging

- Building thoughtful email and CRM flows to nurture post-event engagement

- Creating continuity between summer deals and fall launches

- Optimizing Subscribe & Save and loyalty-building tactics within the channel

At Front Row, we see Prime Day as more than a sales surge. It’s a strategic inflection point, and a chance to bring in new audiences.

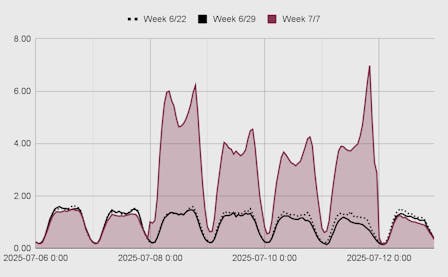

The First Day Had the Strongest Sales, But Friday Surprised Everyone

As expected, sales spiked as soon as deals went live, peaking at 8 AM and again at 8 PM on the first day of Prime Day. But Front Row's data uncovered a surprise: Friday at 8 PM was the single highest-performing hour of the week.

This insight underscores the importance of extending promotional strategies beyond the core event window and speaks to the nuance of planning hourly and daily activation calendars that keep brands competitive for longer.

Top Deals Performed the Best But Participation Mattered More

The deal structure matters. Strike-Through Pricing, Prime Exclusive Discounts, and Best Deals all delivered comparable sales lifts. However, our analysis revealed that even non-promoted products saw gains when part of a larger brand campaign. Put simply: brands that invested in Prime Day saw halo effects across their catalog, while those that opted out missed the moment entirely.

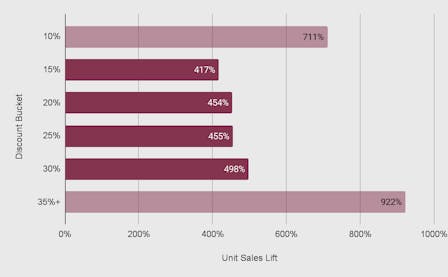

Does Discount Amount Matter?

There’s a common assumption that deeper discounts automatically translate to better results, but our data paints a more nuanced picture. While larger discounts did correlate with increased sales, the magnitude of lift was not always proportionate to the size of the markdown.

The takeaway? Brands should participate with strategic, brand-right discounting, but not chase the deepest cut. Optimizing for visibility, conversion, and profitability remains the sweet spot.

Haircare & Color Cosmetics Saw the Biggest Increases

Among the sectors we serve, Hair Care and Color Cosmetics saw the highest average sales lift. That performance was driven not only by high consumer demand but also by strong promotional planning and clear brand positioning.

With many SKUs benefiting from “hero product” strategies, we saw 7x sales days for some clients compared to their baseline. When the right assortment, promotion, and creative come together, powered by Catapult, the impact is outsized.

Performance Now, Momentum Ahead

This Prime Day, performance wasn’t just good. It was differentiated.

Our brands captured outsized share, grew their customer bases, and drove lasting impact. And with Q4 fast approaching, we’re helping clients apply the same level of strategy, data, and execution to Black Friday, Cyber Monday, and beyond.

Looking for a new strategic partner to scale your Amazon business? Connect with us below!